Quantity Theory of Money: Fisher’s Transactions and Cambridge Cash Balance Approach

1. Quantity Theory of Money: Fisher’s Transactions Approach:

The general level of prices is determined, that is, why at sometimes the general level of prices rises and sometimes it declines. Sometime back it was believed by the economists that the quantity of money in the economy is the prime cause of fluctuations in the price leve

The theory that increases in the quantity of money leads to the rise in the general price was effectively put forward by Irving Fisher.’ They believed that the greater the quantity of money, the higher the level of prices and vice versa.

Therefore, the theory which linked prices with the quantity of money came to be known as quantity theory of money. In the following analysis we shall first critically examine the quantity theory of money and then explain the modem view about the relationship between money and prices and also the determination of general level of prices.

The quantity theory of money seeks to explain the value of money in terms of changes in its quantity. Stated in its simplest form, the quantity theory of money says that the level of prices varies directly with quantity of money. “Double the quantity of money, and other things being equal, prices will be twice as high as before, and the value of money one-half. Halve the quantity of money and, other things being equal, prices will be one-half of what they were before and the value of money double.”

The theory can also be stated in these words: The price level rises proportionately with a given increase in the quantity of money. Conversely, the price level falls proportionately with a given decrease in the quantity of money, other things remaining the same

There are several forces that determine the value of money and the general price level.

The general price level in a community is influenced by the following factors:

(a) The volume of trade or transactions;

(b) The quantity of money

(c) Velocity of circulation of money.

The first factor, the volume of trade or transactions, depends upon the supply or amount of goods and services to be exchanged. The greater the amount or supply of goods in an economy, the larger the number of transactions and trade, and vice versa.

But the classical and neoclassical economists who believed in the quantity theory of money assumed that Jull employment of all resources (including labour) prevailed in the economy. Resources being fully employed, the total output or supply of goods (and therefore the total trade or transactions) cannot increase. Therefore, those who believed in the quantity theory of money assumed that the total volume of trade or transactions remained the same.

The second factor in the determination of general level of prices is the quantity of money. It should be noted that the quantity of money in the economy consists of not only the notes and currency issued by the Government but also the amount of credit or deposits created by the bank

The third factor influencing the price level is the velocity of circulation. A unit of money is used for exchange and transactions purposes not once but several times in a year. During several exchanges of goods and services, a unit of money passes from one hand to another.

Thus, if a single rupee is used five times in a year for exchange of goods and services, the velocity of circulation is 5. Hence, the velocity of money is the number of times a unit of money changes hands during exchanges in a year. The work done by one rupee which is circulated five times in a year is equal to that done by the five rupees which change hands only once each.

Let us illustrate the quantity theory of money. Suppose in a country there is only one good, wheat, which is to be exchanged. The total output of wheat is 2,000 quintals in a year. Further suppose that the government has issued money equal to Rs. 25,000 and no credit is issued by the banks. We further assume that one rupee is used four times in a year for exchange of wheat.

That is, velocity of circulation of money is four. Under these circumstances, 2,000 quintals of wheat are to be exchanged for Rs. 1, 00,000 (25,000 x 4 = 1, 00,000). The price of wheat will be 1, 00,000/2,000 = Rs. 50 per quintal. Suppose the quantity of money is doubled to Rs. 50,000, while the output of wheat remains at 2,000 quintals. As a result of this increase in the quantity of money, the price of wheat will rise to 2, 00,000/2,000 = Rs. 100 per quintal

Thus with doubling of the quantity of money, the price has doubled. If the quantity of money is further increased to Rs. 75,000, the amount of wheat remaining constant, the price level will rise to 3,00,000/2,000 = Rs. 150 per quintal. It is thus clear that if the volume of transactions, i.e., output to be exchanged remains constant, the price level rises with the increase in the quantity of money.

Fisher’s Equation of Exchange:

An American economist, Irving Fisher, expressed the relationship between the quantity of money and the price level in the form of an equation, which is called ‘the equation of exchange’.

This is:

PT = MV….(1)

Or P = MV/T

Where P stands for the average price level:

T stands for total amount of transactions (or total trade or amount of goods and services, raw materials, old goods etc.)

M stands for the quantity of money; and

V stands for the transactions velocity of circulation of money.

The equation (1) or (2) is an accounting identity and true by definition. This is, because MV which represents money spent on transactions must be equal to Pr which represents money received from transactions.

However, the equation of exchange as given in equations (1) and (2) has been converted into a theory of determination of general level of prices by the classical economists by making some assumptions. First, it has been assumed that the physical volume of transactions is constant because it is determined by a given amount of real resources, the given level of technology and the efficiency with which the given available resources are used.

These real factors determine a level of aggregate output which necessitates various types of transactions. Another crucial assumption is that transactions velocity of circulation (V) is also constant. The quantity theorists accordingly believed that velocity of circulation (V) depends on the methods and practices of factor payments such as frequency of wage payments to the workers, and habits of the people regarding spending their money incomes after they receive them.

Further, velocity of circulation of money also depends on the development of banking and credit system, that is, the ways and speed with which cheques are cleared, loans are granted and repaid. According to them, these practices do not change in the short run.

This assumption is very crucial for the quantity theory of money because when the quantity of money is increased this may cause a decline in velocity of circulation of money, then MV may not change if the decline in V offsets the increase in M. As a result, increase in M will not affect PY.

The quantity theorists believed that the volume of transactions (T) and the changes in it were largely independent of the quantity of money. Further, according to them, changes in velocity of circulation (VO and price level (P) do not cause any change in volume of transactions except temporarily.

Thus classical economists who put forward the quantity theory of money believed that the number of transactions (which ultimately depends on aggregate real output) does not depend on other variables (M, V and P) in the equation of exchange. Thus we see that the assumption of constant V and T converts the equation of exchange (MV = PT), which is an accounting identity, into a theory of the determination of general price level.

The quantity of money is fixed by the Government and the Central Bank of a country. Further, it is assumed that quantity of money in the economy depends upon the monetary system and policy of the central bank and the Government and is assumed to be autonomous of the real forces which determine the volume of transactions or national outp

Now, with the assumptions that M and V remain constant, the price level P depends upon the quantity of money M; the greater the quantity of M, the higher the level of prices. Let us give a numerical example.

Suppose the quantity of money is Rs. 5, 00,000 in an economy, the velocity of circulation of money (V) is 5; and the total output to be transacted (T) is 2, 50,000 units, the average price level (P) will be:

P = MV/T

= 5, 00,000 × 5/ 2, 50,000 = 2,500,000/ 2, 50,000

= Rs. 10 per unit.

If now, other things remaining the same, the quantity of money is doubled, i.e., increased to Rs. 10, 00,000 then:

P = 10, 00,000 × 5/ 2, 50,000 = Rs. 20 per unit

We thus see that according to the quantity theory of money, price level varies in direct proportion to the quantity of money. A doubling of the quantity of money (M) will lead to the doubling of the price level. Further, since changes in the quantity of money are assumed to be independent or autonomous of the price level, the changes in the quantity of money become the cause of the changes in the price level.

Quantity Theory of Money: Income Version:

Fisher’s transactions approach to quantity theory of money described in equation (1) and (2) above considers such variables as total volume of transaction (T) and average price level of these transactions are conceptually vague and difficult to measure.

Therefore, in later years quantity theory was formulated in income from which considers real B

income or national output (i.e., transactions of final goods only) rather than all transactions. As the data regarding national income or output is readily available, the income version of the quantity theory is being increasingly used. Moreover, the average price level of output is a more meaningful and useful concept.

Indeed, in actual practice, the general price level in a country is measured taking into account only the prices of final goods and services which constitute national product. It may be noted that even in this income version of the quantity theory of money, the function of money is considered to be a means of exchange as in the transactions approach of Fisher.

In this approach, the concept of income velocity of money has been used instead of transactions velocity of circulation. By income velocity we mean the average number of times per period a unit of money is used in making payments involving final goods and services, that is, national product or national income. In fact, income velocity of money is measured by Y/M where Y stands for real national income and M for the quantity of money.

In view of the above, the income version of quantity theory of money is written as under:

MV = PY…(3)

P = MV/PY … (4)

Where

M = Quantity of money

V = Income velocity of money

P = Average price level of final goods and services

Y = Real national income (or aggregate output)

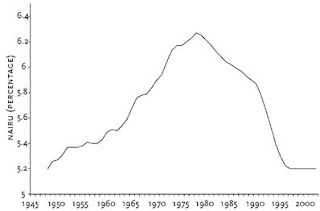

Dia 20.1

Quantity Theory of MoneyLike that in the transactions approach, in this new income version of the quantity theory also the different variables are assumed to be independent of each other. Further, income velocity of money (V) and real income or aggregate output (Y) is assumed to be given and constant during a short period.

More specifically, they do not vary in response to the changes in M. In fact, real income or output (Y) is assumed to be determined by the real sector forces such as capital stock, the amount and skills of labour, technology etc. But as these factors are taken to be given and constant in the short ran, and further full employment of the given resources is assumed to be prevailing due to the operation of Say’s law and wage-price flexibility supply of output is taken to be inelastic and constant for purposes of determination of price level.

It follows from equations (3) and (4) above that with income velocity (V) and national output (F) remaining constant, price level (P) is determined by the quantity of money (M).

Classical quantity theory of money is illustrated in Fig. 20.1 through aggregate demand and aggregate supply model. It is worth noting that the quantity of money (A/) multiplied by the income velocity of circulation (V), that is, MV gives us aggregate expenditure in the quantity theory of money. Now with a given quantity of money, say M1 and constant velocity of money V, we have a given amount of monetary expenditure (M1 V).

Given this aggregate expenditure, at a lower price level more quantities of goods can be purchased and at a higher price level, less quantities of goods can be purchased. Therefore, in accordance with classical quantity theory of money aggregate demand representing M1 slopes downward as shown by the aggregate demand curve AD1 in Fig. 20.1. If now the quantity of money is increased, say to M2, aggregate demand curve representing new aggregate monetary expenditure M2 V will shift upward.

As regards, aggregate supply curve, due to the assumption of wage-price flexibility, it is perfectly inelastic at full-employment level of output as is shown by the vertical aggregate supply curve AS in Fig. 20.1. Now, with a given quantity of money equal to M1, aggregate demand curve AD1 cuts the aggregate supply curve AS at point E and determines price level OP1.

Now, if the quantity of money is increased to M2, the aggregate demand curve shifts upward to AD2. It will be seen from Fig. 20.1 that with the increase in aggregate demand to AD2 consequent to the expansion in money supply to M2, excess demand equal to EB emerges at the current price level OP1. This excess demand for goods and services will lead to the rise in price level to OP2 at which again aggregate quantity demanded equals the aggregate supply which remains unchanged at OY due to the existence of full employment in the economy.

2. Quantity Theory of Money: The Cambridge Cash Balance Approach:

The equation of exchange has been stated by Cambridge economists, Marshall and Pigou, in a form different from Irving Fisher. Cambridge economists explained the determination of value of money in line with the determination of value in general.

Value of a commodity is determined by demand for and supply of it and likewise, according to them, the value of money (i.e., its purchasing power) is determined by the demand for and supply of money. As studied in cash-balance approach to demand for money Cambridge economists laid stress on the store of value function of money in sharp contrast to the medium of exchange function of money emphasised by in Fisher’s transactions approach to demand for money.

According to cash balance approach, the public likes to hold a proportion of nominal income in the form of money (i.e., cash balances). Let us call this proportion of nominal income that people want to hold in money as k.

Then cash balance approach can be written as:

Md =kPY ….(1)

Y = real national income (i.e., aggregate output)

P = the price level PY = nominal national income

k = the proportion of nominal income that people want to hold in money

Md = the amount of money which public want to hold

Now, for the achievement of money-market equilibrium, demand for money must equal worth the supply of money which we denote by M. It is important to note that the supply of money M is exogenously given and is determined by the monetary policies of the central bank of a country. Thus, for equilibrium in the money market.

M = Md

As Md =kPY

Therefore, in equilibrium M = kPY …(2)

Monetary equilibrium Cambridge cash balance approach is shown in Fig. 20.2 where demand for money is shown by a rising straight line kPY which indicates that with k and Y being held constant demand for money increases proportionately to the rise in price level. As price level rises people demand more money for transaction purposes.

Dia 20.2

purposes.Determination of Price Level:Cambridge Cash Balance ApproachNow, if supply of money fixed by the Government (or the Central Bank) is equal to M0, the demand for money APK equals the supply of money, M0 at price level P0. Thus, with supply of money equal to M0 equilibrium price level P0 is determined. If money supply is increased, how the monetary equilibrium will change? Suppose money supply is increased to M1 at the initial price level P0 the people will be holding more money than they demand at it.

Therefore, they would want to reduce their money holding. In order to reduce their money holding they would increase their spending on goods and services. In response to the increase in money spending by the households the firms will increase prices of their goods and services.

C

As prices rise, the households will need and demand more money to hold for transaction purposes (i.e., for buying goods and services). It will be seen from Fig. 20.2 that with the increase in money supply to M1 new equilibrium between demand for money and supply of money is attained at point E1 on the demand for money curve kPY and price level has risen to P1.

It is worth mentioning that k in the equations (1) and (2) is related to velocity of circulation of money V in Fisher’s transactions approach. Thus, when a greater proportion of nominal income is held in the form of money (i.e., when k is higher), V falls. On the other hand, when less proportion of nominal income is held in money, K rises. In the words of Crowther, “The higher the proportion of their real incomes that people decide to keep in money, the lower will be the velocity of circulation, and vice versa.

It follows from above that k = 1/V. Now, rearranging equation (2) we have cash balance approach in which P appears as dependent variable. Thus, on rearranging equation (2) we have

P = 1/k.M/Y…………(3)

Like Fisher’s equation, cash balance equation is also an accounting identity because k is defined as:

Quantity of Money Supply/National Income, that is, M/PY

Now, Cambridge economists also assumed that k remains constant. Further, due to their belief that wage-price flexibility ensures full employment of resources, the level of real national income was also fixed corresponding to the level of aggregate output produced by full employment of resources.

Thus, from equation (3) it follows that with k and Y remaining constant price level (P) is determined by the quantity of money (M); changes in the quantity of money will cause proportionate changes in the price level.

Some economists have pointed out similarity between Cambridge cash-balance approach and

Fisher’s transactions approach. According to them, k is reciprocal of V (k = 1/V or V = 1/k). Thus in equation (2) if we replace k by , we have

M = 1/PY

Or MV=PY

Which is income version of Fisher’s quantity theory of money? However, in spite of the formal similarity between the cash balance and transactions approaches, there are important conceptual differences between the two which makes cash balance approach superior to the transactions approach. First, as mentioned above.

Fisher’s transactions approach lays stress on the medium of exchange function of money, that is, according to its people want money to use it as a means of payment for buying goods and services. On the other hand, cash balance approach emphasizes the store-of-value function of money. They hold money so that some value is stored for spending on goods and services after some lapse of time.

Further, in explaining the factors which determine velocity of circulation, transactions approach points to the mechanical aspects of payment methods and practices such as frequency of wages and other factor payments, the speed with which funds can be sent from one place to another, the extent to which bank deposits and cheques are used in dealing with others and so on.

On the other hand, k in the cash balance approach is behavioural in nature. Thus, according to Prof S.B. Gupta, ”Cash- balance approach is behavioural in nature: it is build around the demand for money, however simple. Unlike Fisher s V, k is a behavioural ratio. As such it can easily lead to stress being placed on the relative usefulness of money as an asset.”

Thirdly, cash balance approach explains determination of value of money in a framework of general demand-supply analysis of value. Thus, according to this approach value of money (that is, its purchasing power is determined by the demand for and supply of money).

To sum up cash balance approach has made some improvements over Fisher’s transactions approach in explaining the relation between money and prices. However it is essentially the same as the Fisher’s transactions approach. Like Fisher’s approach if considers substitution between money and commodities.

That is, if they decide to hold less money, they spend more on commodities rather than on other assets such as bonds, shares real property, and durable consumer goods. Further, like Fisher’s transactions approach it visualises changes in the quantity of money causes proportional changes in the price level.

Like Fisher’s approach, cash balance approach also assumes that full- employment of resources will prevail due to the wage-price flexibility. Hence, it also believes the aggregate supply curve as perfectly inelastic at full-employment level of output.

An important limitation of cash balance approach is that it also assumes that the proportion to income that people want to hold in money, that is, k, remains constant. Note that. In practice it has been found that proportionality factor k or- velocity of circulation has not remained constant but has been fluctuating, especially in the short run.

Besides, cash-balance approach falls short of considering demand for money as an asset. If demand for money as an asset were considered, it would have a determining influence on the rate of interest on which amount of investment in the economy depends. Investment plays an important role in the determination of/level of real income in the economy.

It was left to J.M. Keynes who later emphasised the role of demand for money as an asset which was one of the alternative assets in which individuals can keep their income or wealth. Finally, it may be mentioned that other criticisms of Fisher’s transactions approach to quantity theory of money discussed above equally apply to the Cambridge cash balance approach.

Keynes’s Critique of the Quantity Theory of Money:

The quantity theory of money has been widely criticised.

The following criticisms have been levelled against the quantity theory of money lay by Keynes and his followers:

1. Useless truism:

With the qualification that velocity of money (V) and the total output (T) remain the same, the equation of exchange (MV= PT) is a useless truism. The real trouble is that these things seldom remain the same. They change not only in the long run but also in a short period. Fisher’s equation of exchange simply tells us that expenditure made on goods (MV) is equal to the value of output of goods and services sold (PT).

2. Velocity of money is not stable:

Keynesian economists have challenged the assumption that velocity of money remains stable. According to them, velocity of money changes inversely with the change in money supply. They argue that increase in money supply, demand for money remaining constant, leads to the fall in the rate of interest.

At a lower rate of interest, people will be induced to hold more money as idle cash balances (under speculative motive). This means velocity of circulation of money will be reduced. Thus, if a decline in interest rate reduces velocity, then increase in the money supply will be offset by reduction in velocity, with the result that price level, need not rise when money supply is increased.

3. Increase in quantity of money may not always lead to the increase in aggregate spending or demand:

Further, according to Keynes’ the quantity theory of money is based upon two more wrong assumptions.

Basically, for, the quantity theory to be true, the following two assumptions must hold:

(i) An increase is money supply must lead to an increase in spending, that is, aggregate demand i.e., no part of additional money created should be kept in idle hoards.

(ii) The resulting increase in spending or aggregate demand must face a totally inelastic output.

Both the assumptions according to Keynes, lack generality and, therefore, it either of them does not hold, the quantity theory cannot be accepted as a valid explanation of the changes in price level.

Let us take the first assumption. Under this assumption, the entire increase in the quantity of money must express itself in the form of increased spending. If spending does not increase, there is no question of a change in prices or output. But, is it valid to make such an assumption?

Obviously, there is no such direct link between the increase in the quantity of money and the increase in the volume of total spending or aggregate demand. No one is going to increase his expenditure simply because the government is printing more notes or the banks are more liberal in their lending policies. Thus, if the demand for money is highly interest-elastic, the increase in money supply will not lead to any appreciable fall in the rate of interest.

With no significant fall in rate of interest, the investment expenditure and expenditure on durable consumer goods will not increase much. As a result, increase in money supply may not lead to increase in expenditure or aggregate demand and therefore price level may remain unaffected.

This is not to say, however, that changes in the quantity of money have no influence whatsoever on the volume of aggregate spending. As we shall show below, changes in the quantity of money are often capable of inducing changes in the volume of aggregate spending. What Keynes and his followers deny is the assertion that there exists a direct, simple, and more or less a proportional relation between variation in money supply and variation in the level of total spending.

4. Assumption of constant volume of transactions or constant level of aggregate output is not valid:

Keys asserted that the assumption of constant aggregate output valid only under conditions of full employment. It is only then that we can assume a totally inelastic supply of output, for all the available resources are being already fully utilised. In conditions of less than full employment, the supply curve of output will be elastic.

Now, if we assume that aggregate spending or demand increases with an increase in the quantity of money, it does not follow that prices must necessarily rise. If the supply curve of output is fairly elastic, D

, it is more likely that effect of an increase in spending will be more to raise production rather than prices.

Of course, at full-employment level every further increase in spending or aggregate demand must lead to the rise in the price level as output is inelastic in supply at full-employment level. Since full-employment cannot be assumed to be a normal affair, we cannot accept the quantity theory of money as a valid explanation of changes in the price level in the short run.

The Demand for Money: The Classical and keynes approach towards demand of money..

The demand fo two important function Money exchange and the second is that it is a store of value. Thus individuals and businesses

What explains changes in the demand for money? There are two views on this issue. The first is the “scale” view which is related to the impact of the income or wealth level upon the demand for money. The demand for money is directly related to the income level. The higher the income level, the greater will be the demand for money.

The second is the “substitution” view which is related to relative attractiveness of assets that can be substituted for money. According to this view, when alternative assets like bonds become unattractive due to fall in interest ssets in cash, and the demand for money increases, and vice versa.

The scale and substitution view combined together have been used to explain the nature of the demand for money which has been split into the transactions demand, the precautionary demand and the speculative demand. There are three approaches to the demand for money: the classical, the Keynesian, and the post-Keynesian. We discuss these approaches below.

The Classical Approach:

The classical economists did not explicitly formulate demand for money theory but their views are inherent in the quantity theory of money. They emphasized the transactions demand for money in terms of the velocity of circulation of money. This is because money acts as a medium of exchange and facilitates the exchange of goods and services. In Fisher’s “Equation of Exchange”

MV=PT

Where M is the total quantity of money, V is its velocity of circulation, P is the price level, and T is the total amount of goods and services exchanged for money.

The right hand side of this equation PT represents the demand for money which, in fact, “depends upon the value of the transactions to be undertaken in the economy, and is equal to a constant fraction of those transactions.” MV represents the supply of money which is given and in equilibrium equals the demand for money. Thus the

Md = PT

This transactions demand for money, in turn, is determined by the level of full employment income. This is because the classicists believed in Say’s Law whereby supply created its own demand, assuming the full employment level of income. Thus the demand for money in Fisher’s approach is a constant proportion of the level of transactions, which in turn, bears a constant relationship to the level of national income. Further, the demand for money is linked to the volume of trade going on in an economy at any time.

Thus its underlying assumption is that people hold money to buy goods.

But people also hold money for other reasons, such as to earn interest and to provide against unforeseen events. It is therefore, not possible to say that V will remain constant when M is changed. The most important thing about money in Fisher’s theory is that it is transferable. But it does not explain fully why people hold money. It does not clarify whether to include as money such items as time deposits or savings deposits that are not immediately available to pay debts without first being converted into currency.

It was the Cambridge cash balance approach which raised a further question: Why do people actually want to hold their assets in the form of money? With larger incomes, people want to make larger volumes of transactions and that larger cash balances will, therefore, be demanded.

The Cambridge demand equation for money is

Md=kPY

where Md is the demand for money which must equal the supply to money (Md=Ms) in equilibrium in the economy, k is the fraction of the real money income (PY) which people wish to hold in cash and demand deposits or the ratio of money stock to income, P is the price level, and Y is the aggregate real income. This equation tells us that “other things being equal, the demand for money in normal terms would be proportional to the nominal level of income for each individual, and hence for the aggregate economy as well.”

Its Critical Evaluation:

This approach includes time and saving deposits and other convertible funds in the demand for money. It also stresses the importance of factors that make money more or less useful, such as the costs of holding it, uncertainty about the future and so on. But it says little about the nature of the relationship that one expects to prevail between its variables, and it does not say too much about which ones might be important.

One of its major criticisms arises from the neglect of store of value function of money. The classicists emphasized only the medium of exchange function of money which simply acted as a go-between to facilitate buying and selling. For them, money performed a neutral role in the economy. It was barren and would not multiply, if stored in the form of wealth.

This was an erroneous view because money performed the “asset” function when it is transformed into other forms of assets like bills, equities, debentures, real assets (houses, cars, TVs, and so on), etc. Thus the neglect of the asset function of money was the major weakness of classical approach to the demand for money which Keynes remedied.

The Keynesian Approach: Liquidity Preference:

Keynes in his General Theory used a new term “liquidity preference” for the demand for money. Keynes suggested three motives which led to the demand for money in an economy: (1) the transactions demand, (2) the precautionary demand, and (3) the speculative demand.

The Transactions Demand for Money:

The transactions demand for money arises from the medium of exchange function of money in making regular payments for goods and services. According to Keynes, it relates to “the need of cash for the current transactions of personal and business exchange” It is further divided into income and business motives. The income motive is meant “to bridge the interval between the receipt of income and its disbursement.”

Similarly, the business motive is meant “to bridge the interval between the time of incurring business costs and that of the receipt of the sale proceeds.” If the time between the incurring of expenditure and receipt of income is small, less cash will be held by the people for current transactions, and vice versa. There will, however, be changes in the transactions demand for money depending upon the expectations of income recipients and businessmen. They depend upon the level of income, the interest rate, the business turnover, the normal period between the receipt and disbursement of income, etc.

Given these factors, the transactions demand for money is a direct proportional and positive function of the level of income, and is expressed as

L1 = kY

Where L1 is the transactions demand for money, k is the proportion of income which is kept for transactions purposes, and Y is the income.

This equation is illustrated in Figure 70.1 where the line kY represents a linear and proportional relation between transactions demand and the level of income. Assuming k= 1/4 and income Rs 1000 crores, the demand for transactions balances would be Rs 250 crores, at point A. With the increase in income to Rs 1200 crores, the transactions demand would be Rs 300 crores at point В on the curve kY.

Fig70.1

If the transactions demand falls due to a change in the institutional and structural conditions of the economy, the value of к is reduced to say, 1/5, and the new transactions demand curve is kY. It shows that for income of Rs 1000 and 1200 crores, transactions balances would Rs 200 and 240 crores at points С and D respectively in the figure. “Thus we conclude that the chief determinant of changes in the actual amount of the transactions balances held is changes in income. Changes in the transactions balances are the result of movements along a line like kY rather than changes in the slope of the line. In the equation, changes in transactions balances are the result of changes in Y rather than changes in k.”

Interest Rate and Transactions Demand:

Regarding the rate of interest as the determinant of the transactions demand for money Keynes made the LT function interest inelastic. But the pointed out that the “demand for money in the active circulation is also the some extent a function of the rate of interest, since a higher rate of interest may lead to a more economical use of active balances.” “However, he did not stress the role of the rate of interest in this part of his analysis, and many of his popularizes ignored it altogether.” In recent years, two post-Keynesian economists William J. Baumol and James Tobin have shown that the rate of interest is an important determinant of transactions demand for money.

They have also pointed out the relationship, between transactions demand for money and income is not linear and proportional. Rather, changes in income lead to proportionately smaller changes in transactions demand.

E

Transactions balances are held because income received once a month is not spent on the same day. In fact, an individual spreads his expenditure evenly over the month. Thus a portion of money meant for transactions purposes can be spent on short-term interest-yielding securities. It is possible to “put funds to work for a matter of days, weeks, or months in interest-bearing securities such as U.S. Treasury bills or commercial paper and other short-term money market instruments.

The problem here is that there is a cost involved in buying and selling. One must weigh the financial cost and inconvenience of frequent entry to and exit from the market for securities against the apparent advantage of holding interest-bearing securities in place of idle transactions balances.

Among other things, the cost per purchase and sale, the rate of interest, and the frequency of purchases and sales determine the profitability of switching from ideal transactions balances to earning assets. Nonetheless, with the cost per purchase and sale given, there is clearly some rate of interest at which it becomes profitable to switch what otherwise would be transactions balances into interest-bearing securities, even if the period for which these funds may be spared from transactions needs is measured only in weeks. The higher the interest rate, the larger will be the fraction of any given amount of transactions balances that can be profitably diverted into securities.”

The structure of cash and short-term bond holdings is shown in Figure 70.2 (A), (B) and (C). Suppose an individual receives Rs 1200 as income on the first of every month and spends it evenly over the month. The month has four weeks. His saving is zero.

Accordingly, his transactions demand for money in each week is Rs 300. So he has Rs 900 idle money in the first week, Rs 600 in the second week, and Rs 300 in the third week. He will, therefore, convert this idle money into interest bearing bonds, as illustrated in Panel (B) and (C) of Figure 70.2. He keeps and spends Rs 300 during the first week (shown in Panel B), and invests Rs 900 in interest-bearing bonds (shown in Panel C). On the first day of the second week he sells bonds worth Rs. 300 to cover cash transactions of the second week and his bond holdings are reduced to Rs 600.

Similarly, he will sell bonds worth Rs 300 in the beginning of the third and keep the remaining bonds amounting to Rs 300 which he will sell on the first day of the fourth week to meet his expenses for the last week of the month. The amount of cash held for transactions purposes by the individual during each week is shown in saw-tooth pattern in Panel (B), and the bond holdings in each week are shown in blocks in Panel (C) of Figure 70.2

The modern view is that the transactions demand for money is a function of both income and interest rates which can be expressed as

L1 = f (Y, r).

This relationship between income and interest rate and the transactions demand for money for the economy as a whole is illustrated in Figure 3. We saw above that LT = kY. If y=Rs 1200 crores and k= 1/4, then LT = Rs 300 crores.

This is shown as Y1 curve in Figure 70.3. If the income level rises to Rs 1600 crores, the transactions demand also increases to Rs 400 crores, given k = 1/4. Consequently, the transactions demand curve shifts to Y2. The transactions demand curves Y1, and Y2 are interest- inelastic so long as the rate of interest does not rise above r8 per cent.

As the rate of interest starts rising above r8, the transactions demand for money becomes interest elastic. It indicates that “given the cost of switching into and out of securities, an interest rate above 8 per cent is sufficiently high to attract some amount of transaction balances into securities.” The backward slope of the K, curve shows that at still higher rates, the transaction demand for money declines.

Thus when the rate of interest rises to r12, the transactions demand declines to Rs 250 crores with an income level of Rs 1200 crores. Similarly, when the national income is Rs 1600 crores the transactions demand would decline to Rs 350 crores at r12 interest rate. Thus the transactions demand for money varies directly with the level of income and inversely with the rate of interest.

The Precautionary Demand for Money:

The Precautionary motive relates to “the desire to provide for contingencies requiring sudden expenditures and for unforeseen opportunities of advantageous purchases.” Both individuals and businessmen keep cash in reserve to meet unexpected needs. Individuals hold some cash to provide for illness, accidents, unemployment and other unforeseen contingencies.

Similarly, businessmen keep cash in reserve to tide over unfavourable conditions or to gain from unexpected deals. Therefore, “money held under the precautionary motive is rather like water kept in reserve in a water tank.” The precautionary demand for money depends upon the level of income, and business activity, opportunities for unexpected profitable deals, availability of cash, the cost of holding liquid assets in bank reserves, etc.

Keynes held that the precautionary demand for money, like transactions demand, was a function of the level of income. But the post-Keynesian economists believe that like transactions demand, it is inversely related to high interest rates. The transactions and precautionary demand for money will be unstable, particularly if the economy is not at full employment level and transactions are, therefore, less than the maximum, and are liable to fluctuate up or down.

Since precautionary demand, like transactions demand is a function of income and interest rates, the demand for money for these two purposes is expressed in the single equation LT=f(Y, r)9. Thus the precautionary demand for money can also be explained diagrammatically in terms of Figures 2 and 3.

F

The Speculative Demand for Money:

The speculative (or asset or liquidity preference) demand for money is for securing profit from knowing better than the market what the future will bring forth”. Individuals and businessmen having funds, after keeping enough for transactions and precautionary purposes, like to make a speculative gain by investing in bonds. Money held for speculative purposes is a liquid store of value which can be invested at an opportune moment in interest-bearing bonds or securities.

Bond prices and the rate of interest are inversely related to each other. Low bond prices are indicative of high interest rates, and high bond prices reflect low interest rates. A bond carries a fixed rate of interest. For instance, if a bond of the value of Rs 100 carries 4 per cent interest and the market rate of interest rises to 8 per cent, the value of this bond falls to Rs 50 in the market. If the market rate of interest falls to 2 per cent, the value of the bond will rise to Rs 200 in the market.

This can be worked out with the help of the equation

V = R/r

Where V is the current market value of a bond, R is the annual return on the bond, and r is the rate of return currently earned or the market rate of interest. So a bond worth Rs 100 (V) and carrying a 4 per cent rate of interest (r), gets an annual return (R) of Rs 4, that is,

V=Rs 4/0.04=Rs 100. When the market rate of interest rises to 8 per cent, then V=Rs 4/0.08=Rs50; when it fall to 2 per cent, then V=Rs 4/0.02=Rs 200.

Thus individuals and businessmen can gain by buying bonds worth Rs 100 each at the market price of Rs 50 each when the rate of interest is high (8 per cent), and sell them again when they are dearer (Rs 200 each when the rate of interest falls (to 2 per cent).

According to Keynes, it is expectations about changes in bond prices or in the current market rate of interest that determine the speculative demand for money. In explaining the speculative demand for money, Keynes had a normal or critical rate of interest (rc) in mind. If the current rate of interest (r) is above the “critical” rate of interest, businessmen expect it to fall and bond price to rise. They will, therefore, buy bonds to sell them in future when their prices rise in order to gain thereby. At such times, the speculative demand for money would fall. Conversely, if the current rate of interest happens to be below the critical rate, businessmen expect it to rise and bond prices to fall. They will, therefore, sell bonds in the present if they have any, and the speculative demand for money would increase.

Thus when r > r0, an investor holds all his liquid assets in bonds, and when r < r0 his entire holdings go into money. But when r = r0, he becomes indifferent to hold bonds or money.

Thus relationship between an individual’s demand for money and the rate of interest is shown in Figure 70.4 where the horizontal axis shows the individual’s demand for money for speculative purposes and the current and critical interest rates on the vertical axis. The figure shows that when r is greater than r0, the asset holder puts all his cash balances in bonds and his demand for money is zero.

This is illustrated by the LM portion of the vertical axis. When r falls below r0, the individual expects more capital losses on bonds as against the interest yield. He, therefore, converts his entire holdings into money, as shown by OW in the figure. This relationship between an individual asset holder’s demand for money and the current rate of interest gives the discontinuous step demand for money curve LMSW.

For the economy as a whole the individual demand curve can be aggregated on this presumption that individual asset-holders differ in their critical rates r0. It is smooth curve which slopes downward from left to right, as shown in Figure 70.5.

Thus the speculative demand for money is a decreasing function of the rate of interest. The higher the rate of interest, the lower the speculative demand for money and the lower the rate of interest, the higher the speculative demand for money. It can be expressed algebraically as Ls = f (r), where Ls is the speculative demand for money and r is the rate of interest.

Geometrically, it is shows in Figure 70.5. The figure shows that at a very high rate of interest rJ2, the speculative demand for money is zero and businessmen invest their cash holdings in bonds because they believe that the interest rate cannot rise further. As the rate of interest falls to say, r8 the speculative demand for money is OS. With a further fall in the interest rate to r6, it rises to OS’. Thus the shape of the Ls curve shows that as the interest rate rises, the speculative demand for money declines; and with the fall in the interest rate, it increases. Thus the Keynesian speculative demand for money function is highly volatile, depending upon the behaviour of interest rates.

Liquidity Trap:

Keynes visualised conditions in which the speculative demand for money would be highly or even totally elastic so that changes in the quantity of money would be fully absorbed into speculative balances. This is the famous Keynesian liquidity trap. In this case, changes in the quantity of money have no effects at all on prices or income. According to Keynes, this is likely to happen when the market interest rate is very low so that yields on bond, equities and other securities will also be low.

At a very low rate of interest, such as r2, the Ls curve becomes perfectly elastic and the speculative demand for money is infinitely elastic. This portion of the Ls curve is known as the liquidity trap. At such a low rate, people prefer to keep money in cash rather than invest in bonds because purchasing bonds will mean a definite loss. People will not buy bonds so long as the interest rate remain at the low level and they will be waiting for the rate of interest to return to the “normal” level and bond prices to fall.

According to Keynes, as the rate of interest approaches zero, the risk of loss in holding bonds becomes greater. “When the price of bonds has been bid up so high that the rate of interest is, say, only 2 per cent or less, a very small decline in the price of bonds will wipe out the yield entirely and a slightly further decline would result in loss of the part of the principal.” Thus the lower the interest rate, the smaller the earnings from bonds. Therefore, the greater the demand for cash holdings. Consequently, the Ls curve will become perfectly elastic.

Further, according to Keynes, “a long-term rate of interest of 2 per cent leaves more to fear than to hope, and offers, at the same time, a running yield which is only sufficient to offset a very small measure of fear.” This makes the Ls curve “virtually absolute in the sense that almost everybody prefers cash to holding a debt which yields so low a rate of interest.”

Prof. Modigliani believes that an infinitely elastic Ls curve is possible in a period of great uncertainty when price reductions are anticipated and the tendency to invest in bonds decreases, or if there prevails “a real scarcity of investment outlets that are profitable at rates of interest higher than the institutional minimum.”

The phenomenon of liquidity trap possesses certain important implications.

First, the monetary authority cannot influence the rate of interest even by following a cheap money policy. An increase in the quantity of money cannot lead to a further decline in the rate of interest in a liquidity-trap situation. Second, the rate of interest cannot fall to zero.

Third, the policy of a general wage cut cannot be efficacious in the face of a perfectly elastic liquidity preference curve, such as Ls in Figure 70.5. No doubt, a policy of general wage cut would lower wages and prices, and thus release money from transactions to speculative purpose, the rate of interest would remain unaffected because people would hold money due to the prevalent uncertainty in the money market. Last, if new money is created, it instantly goes into speculative balances and is put into bank vaults or cash boxes instead of being invested. Thus there is no effect on income. Income can change without any change in the quantity of money. Thus monetary changes have a weak effect on economic activity under conditions of absolute liquidity preference.

The Total Demand for Money:

According to Keynes, money held for transactions and precautionary purposes is primarily a function of the level of income, LT=f (F), and the speculative demand for money is a function of the rate of interest, Ls = f (r). Thus the total demand for money is a function of both income and the interest rate:

LT + LS = f (Y) + f (r)

or L = f (Y) + f (r)

or L=f (Y, r)

Where L represents the total demand for money.

Thus the total demand for money can be derived by the lateral summation of the demand function for transactions and precautionary purposes and the demand function for speculative purposes, as illustrated in Figure 70.6 (A), (B) and (C). Panel (A) of the Figure shows ОТ, the transactions and precautionary demand for money at Y level of income and different rates of interest. Panel (B) shows the speculative demand for money at various rates of interest. It is an inverse function of the rate of interest.

For instance, at r6 rate of interest it is OS and as the rate of interest falls to r the Ls curve becomes perfectly elastic. Panel (C) shows the total demand curve for money L which is a lateral summation of LT and Ls curves: L=LT+LS. For example, at rb rate of interest, the total demand for money is OD which is the sum of transactions and precautionary demand ОТ plus the speculative demand TD, OD=OT+TD. At r2 interest rate, the total demand for money curve also becomes perfectly elastic, showing the position of liquidity trap

G

Friedman’s Theory of the Demand for Money (Theory and Criticisms)

Following the publication of Keynes’s the General Theory of Employment, Interest and Money in 1936 economists discarded the traditional quantity theory of money. But at the University of Chicago “the quantity theory continued to be a central and vigorous part of the oral tradition throughout the 1930s and 1940s.”

At Chicago, Milton Friedman, Henry Simons, Lloyd Mints, Frank Knight and Jacob Viner taught and developed ‘a more subtle and relevant version’ of the quantity theory of money in its theoretical form “in which the quantity theory was connected and integrated with general price theory.” The foremost exponent of the Chicago version of the quantity theory of money who led to the so-called “Monetarist Revolution” is Professor Friedman. He, in his essay “The Quantity Theory of Money—A Restatement” published in 1956′, set down a particular model of quantity theory of money. This is discussed below.

Friedman’s Theory:

In his reformulation of the quantity theory, Friedman asserts that “the quantity theory is in the first instance a theory of the demand for money. It is not a theory of output, or of money income, or of the price level.” The demand for money on the part of ultimate wealth holders is formally identical with that of the demand for a consumption service. He regards the amount of real cash balances (M/P) as a commodity which is demanded because it yields services to the person who holds it. Thus money is an asset or capital good. Hence the demand for money forms part of capital or wealth theory.

2 ) Total wealth

For ultimate wealth holders, the demand for money, in real terms, may be expected to be a function primarily of t

The total wealth is the analogue of the budget constraint. It is the total that must be divided among various forms of assets. In practice, estimates of total wealth are seldom available. Instead, income may serve as an index of wealth. Thus, according to Friedman, income is a surrogate of wealth.

2. The Division of Wealth between Human and Non-Human Forms:

The major source of wealth is the productive capacity of human beings which is human wealth. But the conversion of human wealth into non-human wealth or the reverse is subject to institutional constraints. This can be done by using current earnings to purchase non-human wealth or by using non-human wealth to finance the acquisition of skills. Thus the fraction of total wealth in the form of non-human wealth is an additional important variable. Friedman calls the ratio of non-human to human wealth or the ratio of wealth to income as w.

3. The Expected Rates of Return on Money and Other Assets:

These rates of return are the counterparts of the prices of a commodity and its substitutes and complements in the theory of consumer demand. The nominal rate of return may be zero as it generally is on currency, or negative as it sometimes is on demand deposits, subject to net service charges, or positive as it is on demand deposits on which interest is paid, and generally on time deposits. The nominal rate of return on other assets consists of two parts: first, any currently paid yield or cost, such as interest on bonds, dividends on equities, and costs of storage on physical assets, and second, changes in the prices of these assets which become especially important under conditions of inflation or deflation.

4. Other Variables:

Variables other than income may affect the utility attached to the services of money which determine liquidity proper. Besides liquidity, variables are the tastes and preferences of wealth holders. Another variable is trading in existing capital goods by ultimate wealth holders. These variables also determine the demand function for money along-with other forms of wealth. Such variables are noted as u by Friedman.

Broadly, total wealth includes all sources of income or consumable services. It is capitalised income. By income, Friedman means “permanent income” which is the average expected yield on wealth during its life time.

Wealth can be held in five different forms: money, bonds, equities, physical goods, and human capital. Each form of wealth has a unique characteristic of its own and a different yield.

1. Money is taken in the broadest sense to include currency, demand deposits and time deposits which yield interest on deposits. Thus money is luxury good. It also yields real return in the form of convenience, security, etc. to the holder which is measured in terms of the general price level (P).

2. Bonds are defined as claim to a time stream of payments that are fixed in nominal units

3. Equities are defined as a claim to a time stream of payments that are fixed in real units.

4. Physical goods or non-human goods are inventories of producer and consumer durable.

5. Human capital is the productive capacity of human beings. Thus each form of wealth has a unique characteristic of its own and a different yield either explicitly in the form of interest, dividends, labour income, etc., or implicitly in the form of services of money measured in terms of P, and inventories. The present discounted value of these expected income flows from these five forms of wealth constitutes the current value of wealth which can be expressed as:

W = y/r

Where W is the current value of total wealth, Y is the total flow of expected income from the five forms of wealth, and r is the interest rate. This equation shows that wealth is capitalised income. Friedman in his latest empirical study Monetary Trends in the United States and the United Kingdom (1982) gives the following demand function for money for an individual wealth holder with slightly different notations from his original study of 1956 as:

M/P = f (y, w; Rm, Rb, Re, gp, u)

Where M is the total stock of money demanded; P is the price level; у is the real income; w is the fraction of wealth in non-human form: Rm is the expected nominal rate of return on money; Rb is the expected rate of return on bonds, including expected changes in their prices; Re is the expected nominal rate of return on equities, including expected changes in their prices; gp=(1/P) (dP/dt) is the expected rate of change of prices of goods and hence the expected nominal rate of return on physical assets; and и stands for variables other than income that may affect the utility attached to the services of money.

The demand function for business is roughly similar, although the division of total wealth and human wealth is not very useful since a firm can buy and sell in the market place and hire its human wealth at will. But the other factors are important.

The aggregate demand function for money is the summation of individual demand functions with M and у referring to per capita money holdings and per capita real income respectively, and w to the fraction of aggregate wealth in nonhuman form.

The demand function for money leads to the conclusion that a rise in expected yields on different assets (Rb, Re and gp) reduces the amount of money demanded by a wealth holder, and that an increase in wealth raises the demand for money. The income to which cash balances (M/P) are adjusted is the expected long term level of income rather than current income being received.

Empirical evidence suggests that the income elasticity of demand for money is greater than unity which means that income velocity is falling over the long run. This means that the long run demand for money function is stable and is relatively interest inelastic, as shown in fig. 68.1. where MD is the demand for money curve. If there is change in the interest rate, the long-run demand for money is negligible.

Friedman’s restatement of the quantity theory of money, the supply of money is independent of the demand for money. The supply of money is unstable due to the actions of monetary authorities. On the other hand, the demand for money is stable. It means that money which people want to hold in cash or bank deposits is related in a fixed way to their permanent income.

If the central bank increases the supply of money by purchasing securities, people who sell securities will find their holdings of money have increased in relation to their permanent income. They will, therefore, spend their excess holdings of money partly on assets and partly on consumer goods and services.

This spending will reduce their money balances and at the same time raise the nominal income. On the contrary, a reduction in the money supply by selling securities on the part of the central bank will reduce the holdings of money of the buyers of securities in relation to their permanent income.

They will, therefore, raise their money holdings partly by selling their assets and partly by reducing their consumption expenditure on goods and services. This will tend to reduce nominal income. Thus, on both counts, the demand for money remains stable. According to Friedman, a change in the supply of money causes a proportionate change in the price level or income or in both. Given the demand for money, it is possible to predict the effects of changes in the supply of money on total expenditure and income.

If the economy is operating at less than full employment level, an increase in the supply of money will raise output and employment with a rise in total expenditure. But this is only possible in the short run. Friedman’s quantity theory of money is explained in terms of Figure 68.2. Where income (Y) is measured on the vertical axis and the demand for the supply of H

money are measured on the horizontal axis. MD is the demand for money curve which varies with income. MS is the money supply curve which is perfectly inelastic to changes in income. The two curves intersect at E and determine the equilibrium income OY. If the money supply rises, the MS curve shifts to the right to M1S1. As a result, the money supply is greater than the demand for money which raises total expenditure until new equilibrium is established at E1 between MD and M1S1, curves. The income rises to OY1.

Thus Friedman presents the quantity theory as the theory of the demand for money and the demand for money is assumed to depend on asset prices or relative returns and wealth or income. He shows how a theory of the stable demand for money becomes a theory of prices and output. A discrepancy between the nominal quantity of money demanded and the nominal quantity of money supplied will be evident primarily in attempted spending. As the demand for money changes in response to changes in its determinants, it follows that substantial changes in prices or nominal income are almost invariably the result of changes in the nominal supply of money.

Its Criticisms:

Friedman’s reformulation of the quantity theory of money has evoked much controversy and has led to empirical verification on the part of the Keynesians and the Monetarists. Some of the criticisms levelled against the theory are discussed as under.

1. Very Broad Definition of Money:

Friedman has been criticised for using the broad definition of money which not only includes currency and demand deposits (М1) but also time deposits with commercial banks (M2). This broad definition leads to the obvious conclusion that the interest elasticity of the demand for money is negligible. If the rate of interest increases on time deposits, the demand for them (M2) rises. But the demand for currency and demand deposits (M1) falls.

So the overall effect of the rate of interest will be negligible on the demand for money. But Friedman’s analysis is weak in that he does not make a choice between long-term and short-term interest rates. In fact, if demand deposits (M1) are used a short-term rate is preferable, while a long-term rate is better with time deposits (M2). Such an interest rate structure is bound to influence the demand for money.

2. Money not a Luxury Good:

Friedman regards money as a luxury good because of the inclusion of time deposits in money. This is based on his finding that there is higher trend rate of the money supply than income in the United States. But no such ‘luxury effect’ has been found in the case of England.

3. More Importance to Wealth Variables:

In Friedman’s demand for money function, wealth variables are preferable to income and the operation of wealth and income variables simultaneously does not seem to be justified. As pointed out by Johnson, income is the return on wealth, and wealth is the present value of income. The presence of the rate of interest and one of these variables in the demand for money function would appear to make the other superfluous.

4. Money Supply not Exogenous:

Friedman takes the supply of money to be unstable. The supply of money is varied by the monetary authorities in an exogenous manner in Friedman’s system. But the fact is that in the United States the money supply consists of bank deposits created by changes in bank lending. Bank lending, in turn, is based upon bank reserves which expand and contract with (a) deposits and withdrawals of currency by non-bank financial intermediaries; (b) borrowings by commercial banks from the Federal Reserve System; (c) inflows and outflows of money from and to abroad: and (d) purchase and sale of securities by the Federal Reserve System. The first three items definitely impart an endogenous element to the money supply. Thus the money supply is not exclusively exogenous, as assumed by Friedman. It is mostly endogenous.

5. Ignores the Effect of Other Variables on Money Supply:

Friedman also ignores the effect of prices, output or interest rates on the money supply. But there is considerable empirical evidence that the money supply can be expressed as a function of the above variables.

6. Does not consider Time Factor:

Friedman does not tell about the timing and speed of adjustment or the length of time to which his theory applies.

7. No Positive Correlation between Money Supply and Money GNP:

Money supply and money GNP have been found to be positively correlated in Friedman’s findings. But, according to Kaldor, in Britain the best correlation is to be found between the quarterly variations in the amount of cash held in the form of notes and coins by the public and corresponding variations in personal consumption at market prices, and not between money supply and the GNP.

8. Conclusion:

Despite these criticisms, “Friedman’s application to monetary theory of the basic principle of capital theory—that is the yield on capital, and capital the present value of income—is probably the most important development in monetary theory since Keynes’s General Theory. Its theoretical significance lies in the conceptual integration of wealth and income as influences on behaviour.”

Friedman Vs Keynes:

Friedman’s demand for money function differs from that of Keynes’s in many ways which are discussed as under.

First, Friedman uses a broader definition of money than that of Keynes in order to explain his demand for money function. He treats money as an asset or capital good capable of serving as a temporary abode of purchasing power. It is held for the stream of income or consumable services which it renders. On the other hand, the Keynesian definition of money consists of demand deposits and non-interest bearing debt of the government.

Second, Friedman postulates a demand for money function quite different from that of Keynes. The demand for money on the part of wealth holders is a function of many variables. These are Rm, the yield on money; Rb, the yield on bonds; Re, the yield on securities; gp, the yield on physical assets; and u referring to other variables. In the Keynesian theory, the demand for money as an asset is confined to just bonds where interest rates are the relevant cost of holding money.

Third, there is also the difference between the monetary mechanisms of Keynes and Friedman as to how changes in the quantity of money affect economic activity. According to Keynes, monetary changes affect economic activity indirectly through bond prices and interest rates.

The monetary authorities increase the money supply by purchasing bonds which raises their prices and reduces the yield on them. Lower yield on bonds induces people to put their money elsewhere, such as investment in new productive capital that will increase output and income. On the other hand, in Friedman’s theory monetary disturbances will directly affect prices and production of all types of goods since people will buy or sell any asset held by them. Friedman emphasises that the market interest rates play only a small part of the total spectrum of rates that are relevant.

Fourth, there is the difference between the two approaches with regard to the motives for holding money balances. Keynes divides money balances into “active” and “idle” categories. The former consist of transactions and precautionary motives, and the latter consist of the speculative motive for holding money. On the other hand, Friedman makes no suchdivision of money balances.

According to him, money is held for a variety of different purposes which determine the total volume of assets held such as money, physical assets, total wealth, human wealth, and general preferences, tastes and anticipations.

Fifth, in his analysis, Friedman introduces permanent income and nominal income to explain his theory. Permanent income is the amount a wealth holder can consume while maintaining his wealth intact. Nominal income is measured in the prevailing units of currency. It depends on both prices and quantities of goods traded. Keynes, on the other hand, does not make such a distinction.

I

Patinkin’s monetary model of quantity theory of money.

Introduction:

In 1956 there appeared a monumental work by Don Patinkin which, inter alia, demonstrated the rigid conditions required for the strict proportionality rule of the quantity theory whilst simultaneously launching a severe attack upon the Cambridge analysis.

Patinkin’s main point of contention was that the advocates of the cash balance approach had failed to understand the true nature of the quantity theory.

Their failure was revealed in the dichotomy which they maintained between the goods market and the money market. Far from integrating the two, as had been claimed, Patinkin held that the neo-classical economists had kept the two rigidly apart.

An increase in the stock of money was assumed to generate an increase in the absolute price level but to exercise no real influence upon the market for commodities. One purpose of Patinkin’s analysis was that only by exerting an influence upon the market for commodities, via the real balance effect, could the strict quantity theory be maintained.

Part of Patinkin’s attack revolved round the nature of the demand curve for money, which according to Patinkin, Cambridge School had generally assumed to be a rectangular hyperbola with constant unit elasticity of the demand for money. As a matter of fact, such a demand curve was implicit in the argument that a doubling of the money stock would induce a doubling of the price level.

Patinkin used the ‘real balance effect’ to demonstrate that the demand curve for money could not be of the shape of a rectangular hyperbola (i.e., the elasticity of demand for money cannot be assumed to be unity except in a stationary state), and moreover, such a demand curve would contradict the strict quantity theory assertion which the Cambridge quantity theorists were trying to establish Patinkin’s main point is that cash balance approach ignored the real balance effect and assumed the absence of money illusion under the assumption of ‘homogeneity postulate’ and, therefore, failed to bring about a correct relation between the theory of money and the theory of value.

The homogeneity postulate implies that the demand functions in the real sectors are assumed to be insensitive to the changes in the absolute level of money prices (i.e., with changes in the quantity of money there will be equi-proportional changes in all money prices), which indicates absence of money illusion and the real balance effect. But this is valid only in a pure barter economy, where there are no money holdings and as such the concept of absolute price level has no or little meaning. The money economy in reality, cannot be without money illusion.

Assumptions:

Patinkin has been able to show the validity and the rehabilitation of the classical quantity theory of money through Keynesian tools with the help of and on the basis of certain basic assumptions: for example, it is assumed that an initial equilibrium exists in the economy, that the system is stable, that there are no destabilizing expectations and finally there are no other factors except those which are specially assumed during the analysis. Again, consumption functions remains stable [the ratio of the flow of consumption expenditure on goods to the stock of money (income velocity) must also be stable.

Further, it is assumed that there are no distribution effects, that is, the level and composition of aggregate expenditures are not affected by the way in which the newly injected money is distributed amongst initial recipients and the reaction of creditors and debtors to a changing price level offset each other. It is also assumed that there is no money illusion. Thus, Patinkin has discussed the validity of the quantity theory only under conditions of full employment, as according to him Keynes questioned its validity even under conditions of full employment.

In Patinkin’s approach we reach the same conclusion as in the old quantity theory of money but we employ modern analytical framework of income-expenditure approach or what is called the Keynesian approach. In other words, Patinkin has rehabilitated the truth contained in the old quantity theory of money with modern Keynesian model

Let us be clear that Patinkin first criticised the so called classical dichotomy of money and then rehabilitated it through a different route. The classical dichotomy which treated relative prices as being determined by real demands (tastes) and real supplies (production conditions), and the money price level as depending on the quantity of money in relation to the demand for money.

In such classical dichotomy there is a real theory of relative prices and a monetary theory of the level of prices, and these are treated as being separate problems, so that in analysing what determines relative prices one does not have to introduce money; whereas in analysing what determines the level of money prices, one does not have to introduce the theory of relative prices. The problem here is (before Patinkin has been) how these two theories can be reconciled—once this has been done, the other problem is— whether the reconciliation permits one to arrive at the classical proposition that an increase in the quantity of money will increase all prices in the same proportion, so that relative prices are not dependent on the quantity of money.

This particular property is described technically as neutrality of money. If money is neutral, an increase in the quantity of money will merely raise the level of money prices without changing relative prices and the rate of interest (which is a particular relative price). In Pigou’s terminology, money will be simply a ‘veil’ covering the underlying operations of the real system.

According to Patinkin this contradiction could be removed and classical theory reconstituted by making the demand and supply functions depend on real cash balances as well as relative prices. While this would eliminate the dichotomy, it would preserve the basic features of the classical monetary theory and particularly the invariance of the real equilibrium of the economy (relative prices and the rate of interest) with respect to changes in the quantity of money.

The real balance effect has been one of the most important innovations in thought concerning the quantity theory of money. This is also called ‘Pigou Effect’, because it was developed by him but Don Patinkin criticized the narrow sense in which the term real balance effect was used by Pigou and he used it in a wider sense.

Suppose a person holds certain money balances and price level falls, the result will be an increase in the real value of these balances. The person will have a larger stock of money than previously, in real terms, though not in nominal units. Similarly, if the private sector of the economy, taken as a whole, has money balances larger than its net debts, than a fall in the price level will lead to increased spending and the quantity theory of money to that extent stands modified, the important variable to watch is not M, but M/P, that is, real money balances. The real balance effect and the demand for money substitutes go to constitute important modifications of the quantity theory of money.

Thus, we find that the solution to this problem, as Patinkin develops it, is to introduce the stock of real balances held by individuals as an influence on their demand for goods. The real balance effect, therefore, is an essential element of the mechanism which works to produce equilibrium in the money market. Suppose, for example, that for some reason prices fall below their equilibrium level—this will increase the real wealth of the cash-holders—lead them to spend more money—and that in turn will drive prices back towards equilibrium.

Thus, the real balance effect is the force behind the working of the quantity theory. Similarly if there is a chance to increase in the price level, this will reduce people’s real balances and therefore lead them to rebuild their balances by spending less, this in turn will force prices back down, so that the presence of real balances as an influence on demands ensures the stability of the price level. Thus, the introduction of the real balance effect disposed of classical dichotomy, that is, it makes it impossible to talk about relative prices without introducing money; but it nevertheless preserve the classical proposition that the real equilibrium of the system will not be affected by the amount of money, all that will be affected will be the level of prices.

“Once the real and monetary data of an economy with outside money are specified”, says Patinkin, “the equilibrium value of relative prices, the rate of interest, and the absolute price level are simultaneously determined by all the markets of the economy.”